This change brings with it exciting new opportunities to both our people and to you, our customers.

Why did we change?

Scale provides more opportunities to innovate and develop and in an evolving marketplace, it is important for us to stay ahead of the game by investing in our capability and development of market leading practices.

To help unlock this potential we joined forces with Integral Insurance Services IIS (Aust) Pty Ltd.

Visit the new Aviso Integral website:

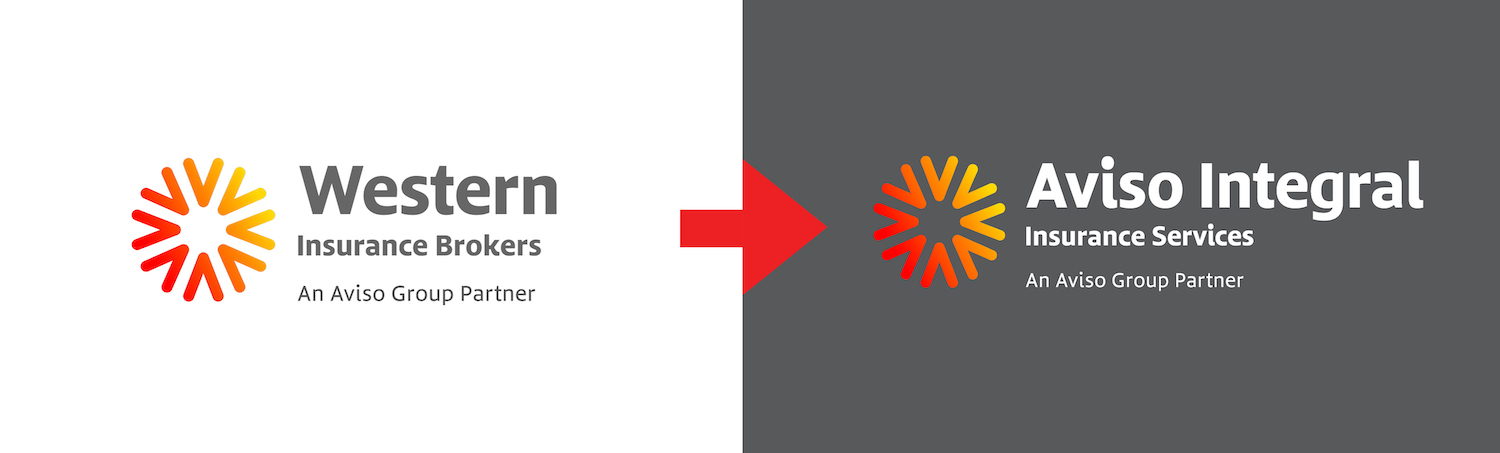

You will notice our existing logo will be replaced by our new Aviso Integral logo on all new documentation from September 26th, 2022. You will also continue to receive your financial services from the same financial services licensee – it will just have a new name: O’Donohue Nominees Pty Ltd trading as Aviso Integral Insurance Services (ABN 28 005 729 831, AFSL 239911).

You have now landed on our new website as Aviso Integral Insurance Services, we welcome you to save the new URL: https://avisointegral.com.au

There will be no changes to your existing insurance policies.

If you wish to contact us as ‘Western Insurance Brokers’ about any services provided to you prior to 26th September 2022 (including complaints), please see below for our previous details as Western Insurance Brokers.

O’Donohue Nominees Pty Ltd trading as Western Insurance Brokers

AFSL Number: 239911

ABN: 28 005 729 831

77 Gellibrand St, Colac Vic 3250

Phone: 03 5231 3088

Email: office@westernib.com.au

Please note, we will still be able to receive emails sent to our existing address in the short term.

If you wish to obtain a copy of the previous Western Insurance Brokers – Financial Services Guide (FSG), please contact us on 03 5231 3088.

No. Everything remains the same for you and your current insurances.

No. All existing policies arranged by Western Insurance Brokers and using the old logo will still be valid and effective.

At this stage we will not be making any changes to our office locations.

If you wish to make a complaint about any services provided to you by us as Western Insurance Brokers prior to 26th September 2022, contact us at the details below. We will try and resolve your complaint quickly and fairly.

If your complaint is not satisfactorily resolved within seven (7) days, please contact us in writing via email office@westernib.com.au or on 03 5231 3088.

Aviso Integral is a member of the Australian Financial Complaints Authority (AFCA). If your complaint cannot be resolved by us to your satisfaction, you have the right to refer the matter to AFCA.

AFCA can be contacted at: Postal Address: Australian Financial Complaints Authority, GPO Box 3, Melbourne, VIC 3001

Ph: 1800 931 678

Fax: 03 9613 6399

Email: info@afca.org.au

Website: www.afca.org.au

O’Donohue Nominees Pty Ltd trading as Western Insurance Brokers

AFSL Number: 239911

ABN: 28 005 729 831

77 Gellibrand St, Colac Vic 3250

Phone: 03 5231 3088

Email: office@westernib.com.au

Please note, we will still be able to receive emails sent to our existing address in the short term.

Please contact our Aviso Integral – Colac office or your broker anytime and we will assist.

You can also find more information about Aviso Integral Insurance Services on the website.

Visit the Aviso Integral website at: https://avisointegral.com.au

General Advice Disclaimer

The information on this website is to be regarded as general advice. Your personal objectives, needs and financial circumstances were not taken into account when preparing this website content. We recommend that you consider the suitability of this general advice, in respect of your objectives, financial situation and needs before acting on it. You should obtain and consider the relevant product disclosure statement and Financial Services Guide from Aviso Integral Insurance Services before making any decision to purchase a financial product.

Aviso Integral Insurance Services are Subscribers to and are bound by the 2022 Insurance Brokers Code of Practice, a full copy of which is available from the National Insurance Brokers Association (NIBA) website.

© Aviso Integral Insurance Services. All Rights Reserved. O'Donohue Nominees Pty Ltd trading as Aviso Integral Insurance Services - ABN 28 005 729 831 - AFSL 239911